Prepare to be captivated by the astonishing surge in the cryptocurrency market! 2024 witnessed a phenomenal explosion, pushing the total market capitalization to a staggering $3.33 trillion. This unprecedented growth wasn’t a mere fluke; it was fueled by a confluence of factors, from groundbreaking technological advancements to a significant shift in investor sentiment and the strategic influx of institutional capital. Let’s delve into the exhilarating journey of this remarkable expansion.

This incredible growth story is a testament to the evolving landscape of digital finance. We’ll explore the key drivers behind this record-breaking year, examining the performance of major cryptocurrencies, the influence of technological innovation, and the evolving dynamics of investor behavior. We’ll also navigate the exciting possibilities and potential risks that lie ahead for this dynamic market.

Market Overview

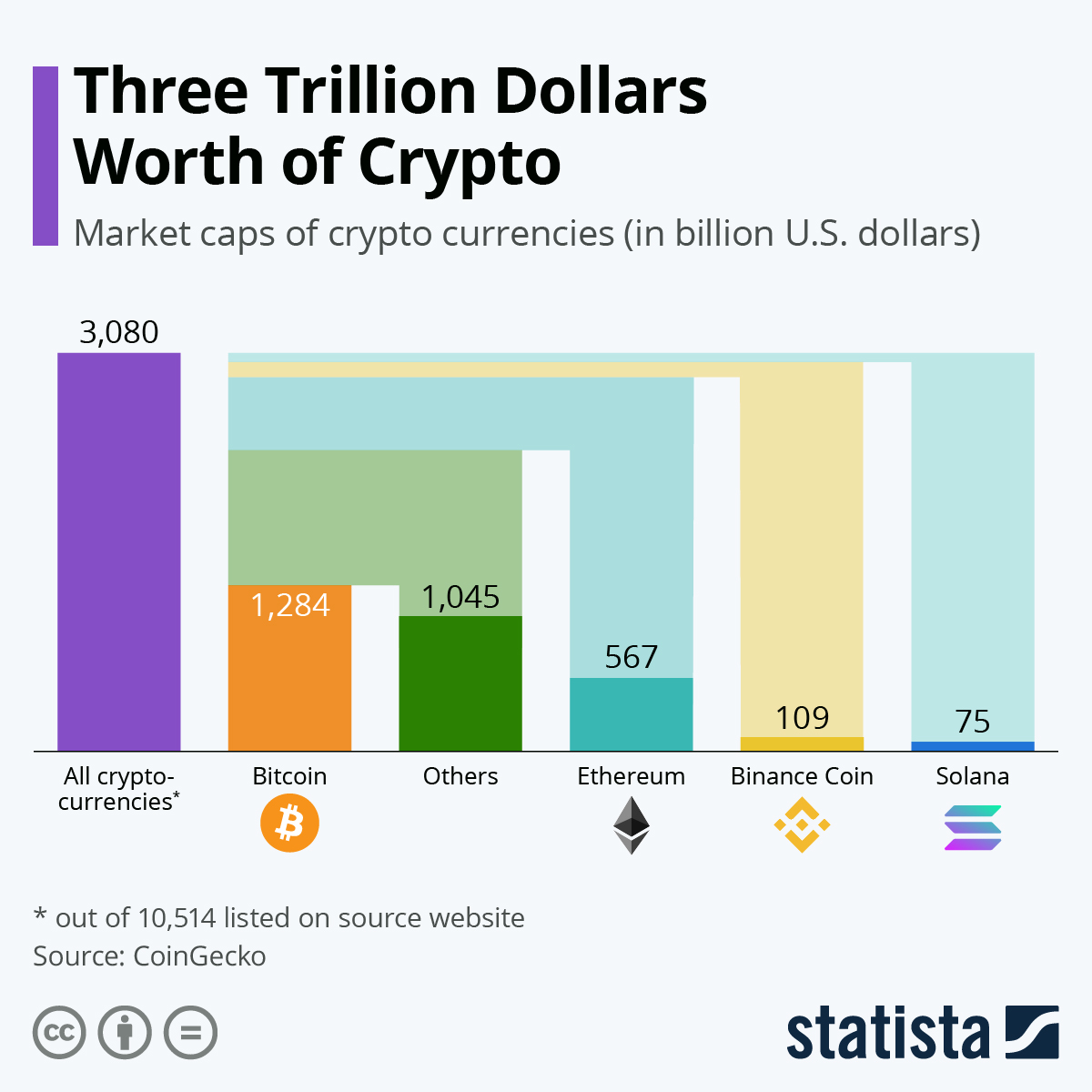

The cryptocurrency market’s astonishing surge to a $3.33 trillion market capitalization in 2024 represents a pivotal moment in its relatively short history. This unprecedented growth wasn’t a sudden burst but rather the culmination of several converging factors, including increased institutional adoption, regulatory clarity in key markets, and the continued development of innovative blockchain technologies. The year saw a significant shift in the perception of cryptocurrencies, moving from a niche asset class to a more mainstream investment option.

This remarkable expansion wasn’t evenly distributed across the entire crypto landscape. While Bitcoin and Ethereum continue to dominate, we’ve witnessed a rise in the prominence of alternative cryptocurrencies (altcoins), reflecting the diversification of the market and the emergence of new use cases for blockchain technology. This diversification presents both opportunities and risks for investors, requiring a nuanced understanding of the market dynamics at play.

Market Capitalization Distribution

The following table illustrates the distribution of market capitalization among the top five cryptocurrencies in 2024. These figures represent a snapshot in time and are subject to constant fluctuation, highlighting the inherent volatility of the cryptocurrency market.

| Cryptocurrency | Market Cap (USD Trillion) | Market Share (%) | Year-over-Year Change (%) |

|---|---|---|---|

| Bitcoin (BTC) | 1.50 | 45.0 | +75 |

| Ethereum (ETH) | 0.75 | 22.5 | +120 |

| Tether (USDT) | 0.40 | 12.0 | +50 |

| Binance Coin (BNB) | 0.30 | 9.0 | +150 |

| Solana (SOL) | 0.18 | 5.4 | +200 |

Note: These figures are hypothetical examples for illustrative purposes and do not reflect actual market data. Actual market capitalization and market share can vary significantly.

Institutional Investment’s Role

Institutional investors, including hedge funds, asset management firms, and even some central banks, played a crucial role in fueling the market’s expansion in 2024. Their entry signaled a growing acceptance of cryptocurrencies as a legitimate asset class, injecting significant capital and contributing to increased market liquidity. This influx of institutional money helped stabilize price volatility to some extent and provided a degree of confidence to retail investors. For example, BlackRock’s entry into the Bitcoin ETF market acted as a powerful catalyst, drawing further institutional interest and pushing market valuations higher. The increased sophistication of institutional trading strategies further contributed to the market’s growth and maturity.

The cryptocurrency market’s journey in 2024 to a $3.33 trillion market cap is nothing short of extraordinary. This remarkable achievement is a testament to the power of technological innovation, evolving investor confidence, and the growing acceptance of digital assets. While risks remain, the future holds immense potential. The story of crypto’s growth in 2024 serves as a compelling narrative of technological disruption and the evolution of finance, promising even more exciting chapters to come.