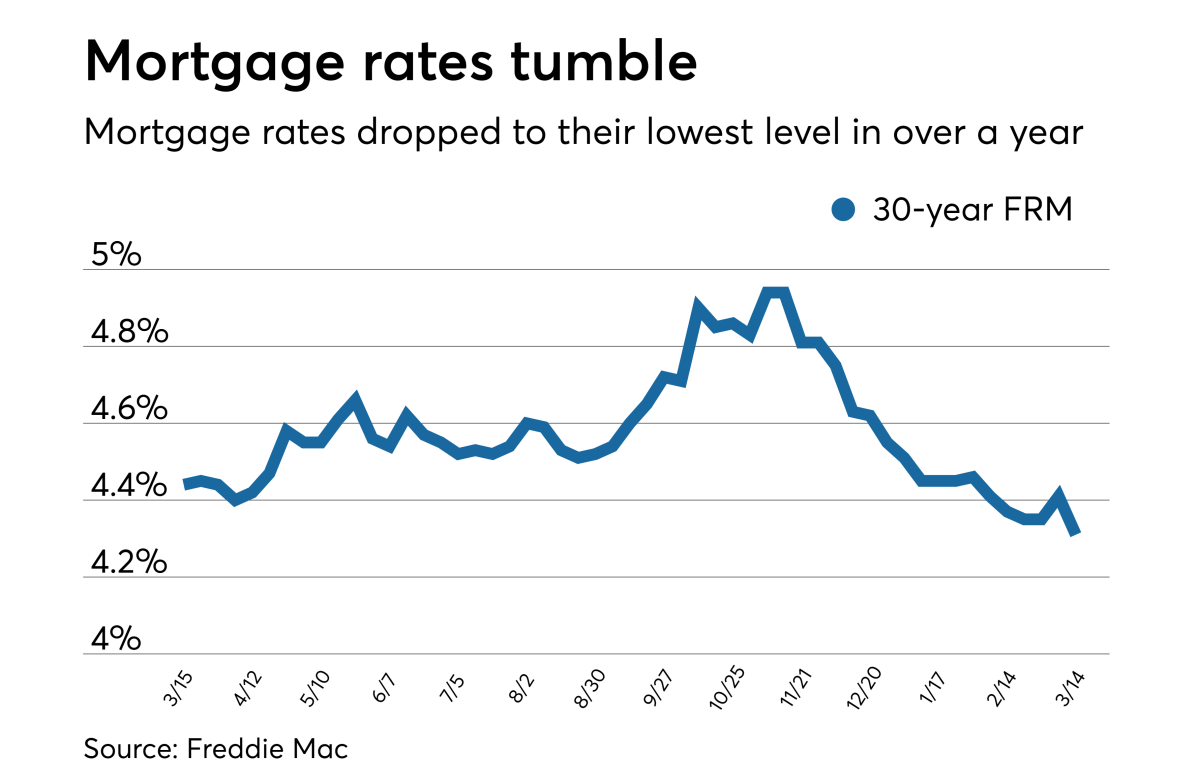

Dreams of homeownership are suddenly looking brighter! This week saw a significant drop in 30-year mortgage rates, a welcome change after a period of higher costs. This shift presents a unique opportunity for prospective buyers, potentially making the dream of owning a home more attainable. Let’s explore what this means for you and how you can navigate this exciting market.

This exciting development in the mortgage market isn’t just a number; it’s a ripple effect impacting affordability, housing inventory, and the overall competitive landscape. Understanding the factors behind this rate decrease, and its implications for your financial future, is key to making informed decisions. We’ll delve into the specifics, examining the current rate landscape, the economic forces at play, and offer practical advice to help you seize this opportunity.

Affordability and Housing Market

The recent drop in 30-year mortgage rates presents a significant shift in the housing market landscape, impacting affordability and sparking renewed interest from potential homebuyers. This change ripples through the entire ecosystem, influencing not only individual purchasing power but also the overall dynamics of supply and demand.

Lower mortgage rates directly translate to lower monthly payments for homebuyers. This increased affordability allows individuals who previously might have been priced out of the market to now consider homeownership. Simultaneously, existing homeowners may find themselves with more disposable income due to reduced mortgage burdens, potentially stimulating further economic activity. This positive feedback loop, however, isn’t without its potential drawbacks.

Impact of Rate Drops on Housing Inventory and Market Competition

The increased affordability spurred by lower rates is likely to fuel a surge in demand. This heightened demand, coupled with a housing inventory that remains relatively tight in many areas, will likely lead to increased competition among buyers. We can expect bidding wars to become more prevalent, potentially driving up home prices despite the lower mortgage rates. This effect counteracts, to some degree, the benefits of lower borrowing costs. For example, in a scenario where a 0.5% rate drop increases demand by 10%, but available homes only increase by 2%, the resulting price increase could offset a portion of the savings from the lower rate.

Consequences of Increased Demand

Increased demand driven by lower mortgage rates can lead to several notable consequences. One significant outcome is a potential acceleration of home price appreciation. As more buyers compete for a limited supply of homes, sellers are empowered to command higher prices. This can exacerbate existing affordability challenges for first-time homebuyers and those with limited budgets. Another consequence is the potential for a faster pace of home sales. Real estate agents might experience increased business as more buyers enter the market. Finally, there’s a risk of creating an unsustainable market bubble if the demand surge is not balanced by an increase in housing supply. The 2008 housing crisis serves as a stark reminder of the dangers of rapid price escalation fueled by easy credit.

Hypothetical Illustration of Lower Rates on Housing Demand

Let’s imagine a scenario in a particular region where the average home price is $400,000. With a 7% interest rate, a 30-year mortgage would result in a monthly payment of approximately $2,650 (excluding taxes and insurance). A drop in interest rates to 6.5% would reduce the monthly payment to roughly $2,530 – a difference of $120 per month. This seemingly small difference can significantly impact affordability for many potential buyers. This $120 saving, while modest on a monthly basis, adds up to $1440 annually. For those on the edge of affordability, this reduction can be the deciding factor in their ability to purchase a home. Furthermore, the increased buying power, amplified by the collective effect across many buyers, could quickly lead to a more competitive market, driving prices upward despite the lower rates. The net effect is a complex interplay between lower borrowing costs and increased market pressure.

The recent drop in 30-year mortgage rates offers a compelling chance for homebuyers to realize their dreams. By understanding the current market dynamics, carefully weighing your financial situation, and acting strategically, you can confidently navigate this favorable environment. Don’t let this opportunity pass you by; take the time to explore your options, compare lenders, and prepare yourself for a potentially rewarding home-buying experience. The market is moving, so make your move!