Imagine a future where your cryptocurrency seamlessly interacts across different blockchains, unlocking unprecedented opportunities and efficiency. This isn’t science fiction; it’s the promise of cross-chain staking protocols. 2024 may be the year this technology truly takes off, driven by advancements in interoperability, security, and scalability. Will the hurdles of regulatory uncertainty and security risks be overcome? Let’s delve into the exciting possibilities and challenges that lie ahead.

This exploration will examine the current state of cross-chain staking, analyzing existing protocols and their limitations. We’ll then project the potential impact of technological breakthroughs anticipated in 2024, exploring how these innovations could revolutionize the landscape. We’ll also consider the influence of market trends, regulatory developments, and inherent security concerns to paint a comprehensive picture of the future of cross-chain staking.

Current State of Cross-Chain Staking

The world of decentralized finance (DeFi) is rapidly evolving, and cross-chain staking protocols are emerging as a key player in this evolution. These protocols aim to bridge the gap between different blockchains, allowing users to stake their assets across multiple networks and earn rewards. This unlocks a wealth of opportunities, from increased diversification to access to higher yields, but also introduces unique challenges. Let’s delve into the current landscape to understand both the potential and the hurdles.

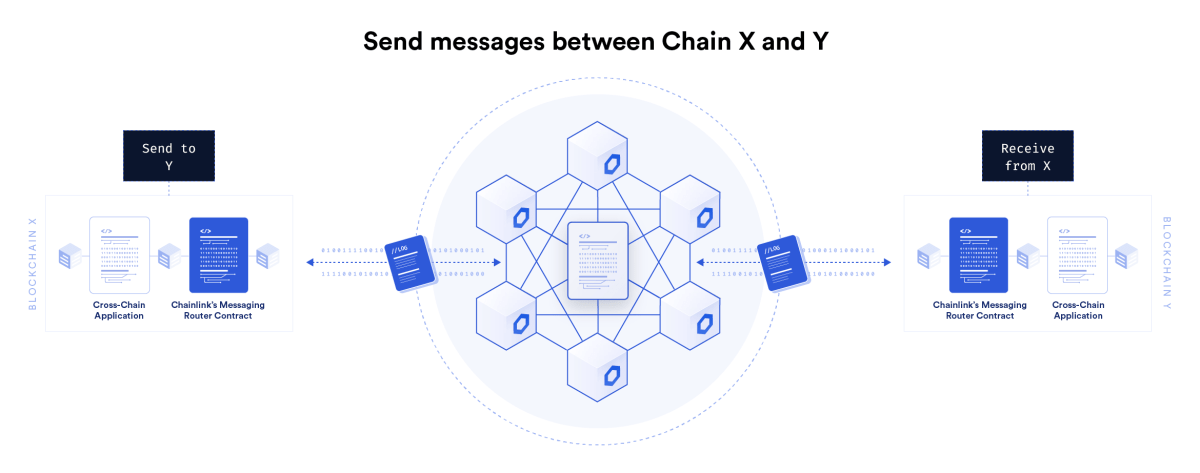

Currently, a number of protocols are pioneering this exciting space, each employing unique approaches to tackle the complexities of cross-chain communication and security. They utilize various technologies to facilitate the secure transfer and staking of assets across diverse blockchain ecosystems. This enables users to participate in the consensus mechanisms of different networks simultaneously, maximizing their staking rewards and contributing to the overall security and decentralization of these networks.

Cross-Chain Staking Protocols: A Comparative Overview

The following table provides a snapshot of some prominent cross-chain staking protocols, highlighting their underlying technologies, supported chains, and key features. Note that this is not an exhaustive list, and the landscape is constantly evolving.

| Protocol Name | Underlying Technology | Supported Chains | Key Features |

|---|---|---|---|

| Allbridge | Interoperability Protocol (IBC) and custom bridges | Cosmos, Ethereum, Polygon, Binance Smart Chain, and others | Supports various asset types, including NFTs; focuses on seamless cross-chain transfers. |

| LayerZero | Omnichain messaging protocol | Ethereum, Avalanche, Polygon, Optimism, Arbitrum, and others | Ultra-fast and low-cost cross-chain communication; designed for high throughput. |

| Cosmos SDK | Inter-Blockchain Communication (IBC) protocol | Numerous Cosmos-based chains | Facilitates communication and asset transfer between IBC-enabled chains; enables building custom cross-chain applications. |

| Synapse | Custom-built bridges and liquidity pools | Ethereum, Polygon, Binance Smart Chain, and others | Focuses on fast and secure cross-chain swaps and bridging; utilizes automated market makers (AMMs). |

Challenges in Cross-Chain Staking

Despite the promise, cross-chain staking protocols face significant challenges. Security is paramount, as any vulnerability could lead to the loss of substantial user funds. The complexity of coordinating across multiple blockchains introduces inherent risks, such as smart contract vulnerabilities or exploits targeting bridge mechanisms. Furthermore, scalability remains a key concern, as the number of transactions and the volume of staked assets grow exponentially. The need to handle a high throughput of cross-chain interactions efficiently and cost-effectively presents a considerable technical challenge. Protocols must carefully balance security and scalability to ensure a reliable and user-friendly experience. This often involves complex trade-offs, requiring innovative solutions and robust security audits.

Security Considerations and Risks

Cross-chain staking, while offering exciting opportunities for increased yield and liquidity, introduces a unique set of security challenges. The inherent complexity of interacting with multiple blockchains, coupled with the significant value locked in staking pools, creates vulnerabilities that require careful consideration and robust mitigation strategies. Understanding these risks is crucial for both protocol developers and users to ensure the safety and longevity of this burgeoning sector.

The interconnected nature of cross-chain staking means that a vulnerability in one chain or protocol can have cascading effects across the entire system. This interconnectedness amplifies the potential impact of attacks, making security a paramount concern. Furthermore, the trust model inherent in cross-chain operations is inherently more complex than single-chain staking, requiring careful analysis of the security assumptions made by each component.

Vulnerabilities in Cross-Chain Communication

Cross-chain communication protocols are susceptible to various attacks, including malicious message relaying, data tampering, and denial-of-service (DoS) attacks. A compromised relay node, for instance, could manipulate transaction data or prevent legitimate transactions from being processed. This could lead to loss of staked assets or the disruption of the entire staking process. For example, imagine a scenario where a malicious actor compromises a relay node responsible for transferring staking rewards from chain B to chain A. They could intercept and redirect these rewards to their own address, resulting in a significant financial loss for stakers. Robust authentication and encryption mechanisms are vital to prevent such scenarios. Employing techniques such as multi-signature verification and secure message channels can significantly enhance the security of cross-chain communication.

Smart Contract Vulnerabilities

Smart contracts underpin the functionality of cross-chain staking protocols. Bugs or vulnerabilities within these contracts can be exploited by malicious actors to drain funds or disrupt the protocol’s operations. These vulnerabilities could include reentrancy attacks, arithmetic overflow errors, or logic flaws that allow unauthorized access to funds. A well-known example is the DAO hack in 2016, which exploited a reentrancy vulnerability in a smart contract to drain millions of dollars. Rigorous audits by independent security firms, formal verification techniques, and the use of secure coding practices are essential to minimize the risk of smart contract vulnerabilities. Furthermore, implementing timelocks and emergency shutdown mechanisms can provide additional layers of protection against potential exploits.

Key Management and Access Control

Secure key management and access control are paramount in cross-chain staking. Compromised private keys can lead to the loss of staked assets and control over validator nodes. This is especially crucial considering the often-large amounts of cryptocurrency locked in these protocols. Implementing multi-signature wallets, hardware security modules (HSMs), and robust key rotation policies are essential steps in mitigating this risk. Furthermore, adopting a principle of least privilege, where only necessary permissions are granted to each component, can further limit the potential damage caused by a security breach. A breach involving compromised private keys could result in an attacker draining the staking pool and taking control of validator nodes, potentially leading to a 51% attack on the network. Using secure key management practices minimizes this possibility.

Example Attack Vector and Prevention

Consider a scenario where a malicious actor identifies a vulnerability in the cross-chain messaging protocol. This vulnerability allows them to inject malicious transactions that appear legitimate but secretly transfer staked assets to their controlled address. The attacker could exploit this by crafting a transaction that appears to be a standard staking reward distribution but secretly redirects the funds to their own wallet. A preventative strategy would involve implementing cryptographic signatures and verification mechanisms for all cross-chain transactions. This ensures that only authorized parties can initiate and execute transactions, thus preventing the injection of malicious messages. Furthermore, regular security audits and penetration testing can help identify and address potential vulnerabilities before they can be exploited.

The year 2024 holds immense potential for cross-chain staking protocols. While challenges remain, particularly in security and regulation, the anticipated technological advancements and growing market demand suggest a bright future. The successful navigation of these hurdles could usher in an era of unprecedented interoperability and efficiency within the cryptocurrency ecosystem, ultimately benefiting both developers and users alike. The journey promises to be dynamic and captivating, and the coming year may well mark a pivotal moment in the evolution of blockchain technology.