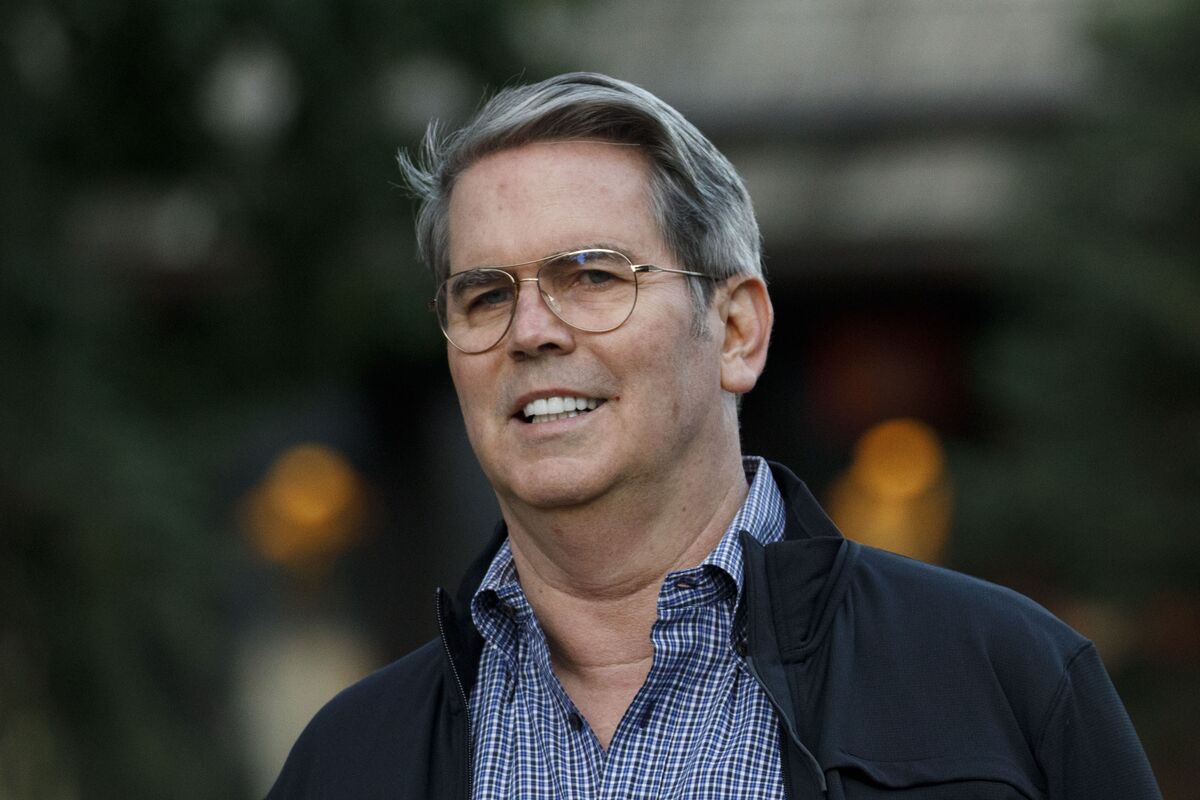

Scott Bessent’s potential candidacy for Treasury Secretary sparks considerable interest, given his extensive career in finance. This examination delves into his impressive trajectory, from his time at Soros Fund Management to leading his own firm, Bessent Capital. We will analyze his investment strategies, financial acumen, and understanding of government finance, ultimately assessing his suitability for this crucial role.

The analysis will explore both his strengths and potential weaknesses, providing a comprehensive overview of his qualifications.

Understanding Mr. Bessent’s suitability requires a multifaceted approach. This involves not only scrutinizing his investment successes and failures but also evaluating his understanding of macroeconomic principles, fiscal policy, and his leadership capabilities. We will consider his experience working (or advising) governmental bodies, his public service record, and his ability to communicate complex financial concepts clearly and effectively to diverse audiences.

The goal is to offer a balanced and informed perspective on his potential contribution as Treasury Secretary.

Financial Expertise and Skills

Scott Bessent’s decades-long career in finance showcases a deep and multifaceted expertise. His skills extend beyond simple investment strategies; he possesses a keen understanding of macroeconomic forces and their impact on market behavior, allowing him to navigate complex financial landscapes with remarkable success. This expertise, honed through years of practical experience and rigorous analysis, makes him a uniquely qualified candidate for high-level financial positions.Bessent’s financial acumen is built upon a solid foundation of portfolio management, risk assessment, and financial modeling.

Scott Bessent’s impressive financial background, including his years at Soros Fund Management, certainly makes him a contender for Treasury Secretary. However, assessing his suitability requires a broader perspective; for example, consider the strategic thinking needed – much like the revamped defensive strategy displayed by Michigan State football, as detailed in this excellent article: Michigan State football improved defensive strategy and future outlook.

Ultimately, Bessent’s ability to navigate complex financial landscapes will be key to his success.

He’s adept at constructing diversified portfolios that balance risk and return, employing sophisticated quantitative models to inform his investment decisions. His understanding of risk isn’t just theoretical; it’s deeply ingrained in his practical approach, enabling him to identify and mitigate potential threats effectively. His financial modeling skills allow for precise projections and strategic allocation of resources, crucial elements in successful financial leadership.

Scott Bessent’s impressive financial background, including his time at Soros Fund Management, certainly makes him a contender for Treasury Secretary. However, it’s also important to consider broader societal perspectives; for example, the overwhelmingly positive reaction to Khalid’s coming out announcement, as detailed in this article Khalid’s coming out announcement public support and LGBTQ+ community response , highlights the growing importance of inclusivity in leadership.

Ultimately, Bessent’s qualifications must be viewed within this evolving social context to fully assess his suitability.

Macroeconomic Analysis and Investment Decisions

Bessent’s investment strategies are demonstrably informed by a thorough understanding of macroeconomic trends. He doesn’t operate in a vacuum; instead, he considers global economic indicators, geopolitical events, and regulatory changes when formulating investment strategies. This holistic approach, which integrates macroeconomic analysis into the core of his investment decision-making, has been a key factor in his consistent success. For example, his anticipation of shifts in currency markets and commodity prices showcases his ability to translate broad macroeconomic trends into specific and profitable investment opportunities.

Comparison with Other Prominent Investors

While comparing investment approaches requires nuance, Bessent’s style differs from some more widely known investors. Unlike some who focus heavily on short-term gains, Bessent’s approach often involves a longer-term perspective, informed by his macroeconomic analysis. This contrasts with certain high-frequency trading strategies, and aligns more with value investing principles, though his methods are certainly sophisticated and far from a simple application of any single school of thought.

His focus on fundamental analysis and his ability to identify undervalued assets set him apart.

Contributions to the Financial Industry

While Bessent’s contributions are primarily through his investment activities and management roles, his influence is felt indirectly through the success of the firms he’s been involved with and the impact of his investment decisions on the market. His strategic investments have contributed to the growth of various companies and sectors, indirectly stimulating economic activity and job creation. While he may not have authored widely-read publications or delivered numerous public speeches, his impact is evident in the tangible results achieved through his investment strategies and management expertise.

Scott Bessent’s deep experience in finance, including his time at Soros Fund Management, certainly makes him a contender for Treasury Secretary. However, considering the often unpredictable nature of Trump-era appointments, I’m reminded of the uproar surrounding Trump’s Pam Bondi Attorney General nomination and Matt Gaetz’s reaction, which you can read about here: Trump’s Pam Bondi Attorney General nomination and Matt Gaetz’s reaction.

That whole situation highlights how even strong qualifications aren’t always a guarantee, leaving Bessent’s prospects somewhat uncertain despite his impressive financial background.

His legacy lies in the successful navigation of complex financial markets and the generation of significant returns for his investors.

Understanding of Government Finance

Scott Bessent’s extensive experience in the private sector, while impressive, doesn’t directly translate to deep familiarity with the intricacies of government finance. His background primarily focuses on navigating complex market dynamics and making high-stakes investment decisions, a skillset undoubtedly valuable, but distinct from the political and budgetary considerations inherent in managing the US Treasury. Assessing his understanding of government finance requires careful consideration of transferable skills and potential learning curves.His career lacks direct experience in government budgeting, fiscal policy formulation, or debt management at a national level.

While his investment acumen involves managing large sums of money and understanding risk, the scale and complexities of national debt and fiscal policy require a specific understanding of political processes, regulatory frameworks, and societal impacts that are different from the private sector.

Bessent’s Experience with Government Entities

Bessent’s career has primarily been within the private investment sphere. There’s no publicly available information indicating direct employment or advisory roles with governmental entities, either domestically or internationally. This lack of direct experience necessitates a thorough evaluation of his capacity to quickly adapt and master the nuances of government finance. The transition would require significant onboarding and mentorship to ensure a smooth and effective performance.

Translating Investment Experience to Treasury Management

Bessent’s expertise in risk assessment, portfolio management, and strategic decision-making under pressure are undoubtedly valuable assets. His experience in navigating volatile markets and making complex financial judgments could prove beneficial in managing the US Treasury’s vast portfolio and navigating economic uncertainties. His ability to analyze data, forecast trends, and make informed decisions based on quantitative and qualitative factors is transferable to the role.

However, the context is critically different. The US Treasury is not a profit-seeking entity; its mandate is far broader, encompassing social and political objectives beyond pure financial gain.

Advantages and Disadvantages of Bessent’s Background

Considering Bessent’s background, a balanced assessment of his suitability for the role of Treasury Secretary is essential. Below is a list of potential advantages and disadvantages:

- Advantages:

- Proven ability to manage large sums of money and complex financial instruments.

- Strong analytical and strategic thinking skills honed through years of successful investing.

- Experience in navigating high-pressure situations and making critical decisions under uncertainty.

- Potential to bring a fresh perspective and innovative approaches to treasury management.

- Disadvantages:

- Lack of direct experience in government budgeting, fiscal policy, and debt management.

- Limited understanding of the political landscape and the complexities of navigating governmental processes.

- Potential challenges in adapting to the public service environment and its differing priorities.

- Need for significant onboarding and mentorship to ensure effective performance.

Leadership and Management Style

Scott Bessent’s leadership style, while not extensively documented publicly, can be inferred from his successful career in finance. His long tenure at Soros Fund Management suggests a capacity for effective leadership within a high-pressure, results-oriented environment. His ability to consistently generate strong returns points to a strategic and decisive management approach.His ability to navigate complex financial markets and achieve consistent success indicates a strong understanding of risk management and a capacity for adapting to rapidly changing circumstances.

This adaptability is a crucial leadership quality, especially in the volatile world of finance and government policy.

Collaboration and Political Navigation

Bessent’s success in the financial world requires collaboration with diverse teams, including analysts, portfolio managers, and other specialists. While specific examples of his collaborations are not readily available in the public domain, his continued success suggests a strong capacity for building consensus and leveraging the expertise of others. His experience managing substantial financial resources also implies an ability to work effectively within complex organizational structures.

Navigating the political landscape as Treasury Secretary would require similar skills in diplomacy and negotiation. His private sector experience, while different from government service, provides a foundation for understanding power dynamics and building alliances.

Communication Skills

Effective communication is essential for a Treasury Secretary. While direct examples of Bessent’s communication style are limited in public sources, his success in the highly competitive world of finance suggests strong communication skills, both written and verbal. The ability to clearly articulate complex financial concepts to both expert and non-expert audiences is crucial for policymaking and public trust.

His presentations to investors and colleagues likely required him to distill complex data and strategies into concise, understandable messages. This ability to translate technical information into clear and persuasive narratives is a key attribute for leadership in government.

| Quality | Supporting Evidence |

|---|---|

| Strategic Decision-Making | Long-term success at Soros Fund Management, indicating consistent ability to make sound investment choices under pressure. |

| Risk Management | Successful navigation of volatile financial markets over many years, demonstrating effective risk assessment and mitigation. |

| Teamwork and Collaboration | Leadership role at Soros Fund Management, implying the ability to build and manage high-performing teams. |

| Adaptability | Consistent success in a rapidly changing and competitive financial environment. |

| Effective Communication | Implied by the need to communicate complex financial information effectively to investors and colleagues within a high-pressure environment. |

In conclusion, Scott Bessent’s extensive financial experience, coupled with his demonstrated investment acumen, presents a compelling case for consideration as Treasury Secretary. While his lack of direct government experience might be perceived as a drawback, his deep understanding of macroeconomic forces, fiscal policy, and his proven leadership abilities could prove invaluable in navigating the complexities of the role. Ultimately, a thorough assessment of his strengths and weaknesses, as Artikeld in this analysis, is essential for a complete evaluation of his qualifications.